|

|

The Highlights

January Revenue Collections Impacted by Lagging PIT Quarterly PaymentsGeneral Fund revenue collections for the month of January were below estimate by $205.6 million, or 5.5%. General Fund tax revenues were $231.3 million, or 6.2%, lower than the monthly estimate, but non-tax revenue exceeded the estimate by $25.7 million. General Fund revenue collections for the fiscal year are $297.5 million, or 1.3%, ahead of estimate. As happened in late November, the Department of Revenue’s implementation of its new Pennsylvania Tax Hub (PATH) software had an unintended impact on January’s revenue postings. Approximately $93.5 million of General Fund deposits was not posted in January and will be carried over and posted to February. The Motor License Fund realized a much smaller impact of approximately $800,000. Absent the PATH posting delay, General Fund revenues would have been $112.1 million below the monthly estimate. Final quarterly estimated personal income tax (PIT) payments for the 2022 calendar year were due in January. These payments were $180 million short of projections for the month. We will know in the coming months whether the shortfall in January’s quarterly payments will carry over into weak annual PIT payments when 2022 tax returns are filed this spring. General (i.e., non-motor vehicle) sales and use tax collections were below estimate by $6 million, or 0.5%, for the month. January’s general sales and use tax collections are the highest of the fiscal year because the taxes collected in December, during the peak of the holiday shopping season, are remitted in January. So, it appears Pennsylvania’s retail sector nearly met expectations during its all-important holiday season. January 2023 General Fund Revenue vs. Monthly Estimate:

Fiscal Year 2022-23 vs. the Official Revenue Estimate To-Date (Amounts Impacted by PATH Delay):

Fiscal Year 2022-23 vs. Fiscal Year 2021-22:

Motor License Fund:

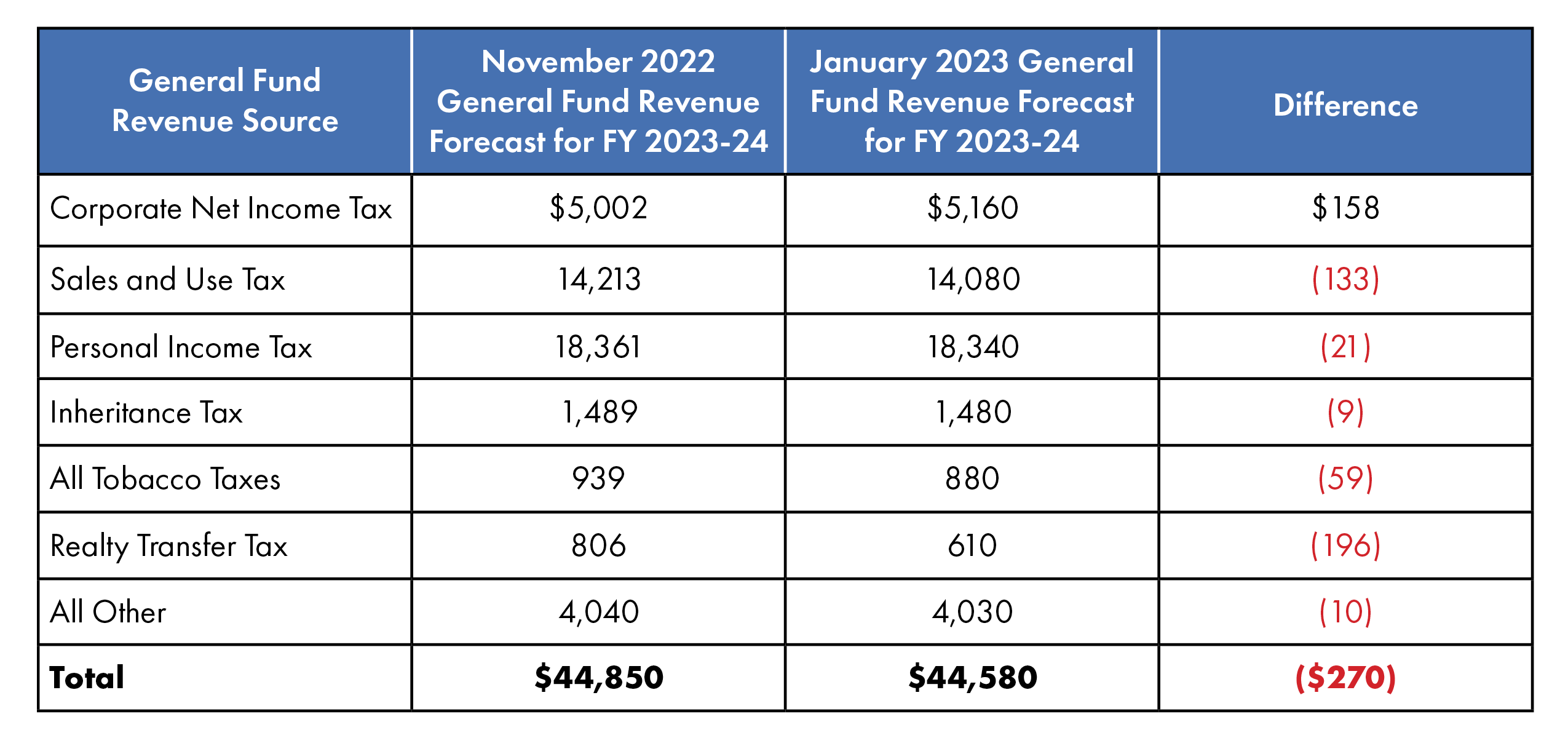

IFO Releases its Mid-Year UpdateThe Independent Fiscal Office (IFO) released its Fiscal Year 2022-23 Mid-Year Update on January 31, 2023. For the current fiscal year, the IFO projects additional General Fund revenue of $27 million as compared to its November 2022 Economic and Budget Outlook forecast. For the upcoming 2023-24 budget year, the IFO projects General Fund revenue of $44.58 billion, which is a $270 million decrease from its November 2022 forecast of two months ago. The following table lays out the differences in the IFO’s FY 2023-24 forecast between November 2022 and January 2023: Millions The full report is available on the IFO’s website at the following URL: Strong Rainy Day Fund Remains a Top PriorityMaking deposits into the Commonwealth’s Rainy Day Fund has been a continuing policy priority for the Senate Republican Caucus. As recently as Fiscal Year 2017-18, the fund was depleted. Unprecedented revenue growth coming out of the Covid-19 pandemic placed the Commonwealth in position to make significant deposits into the fund. The past two fiscal year budgets have included deposits of $2.6 billion and $2.1 billion, respectively. The current fund balance of just over $5 billion equates to 11.6% of total General Fund expenditures and is just below the national average of 12.4%. Continued contributions to further increase the fund balance not only puts the Commonwealth in a better position when needing to respond to unforeseen financial circumstances but also improves the Commonwealth’s standing with the bond market and rating agencies and can decrease interest costs when debt is issued. 22-23 balance in the chart should be $5,032 as of January 31; Y axis title should be “In Millions”

|

|

|

Want to change how you receive these emails? 2026 © Senate of Pennsylvania | https://appropriations.pasenategop.com | Privacy Policy |