August 2023

Highlights

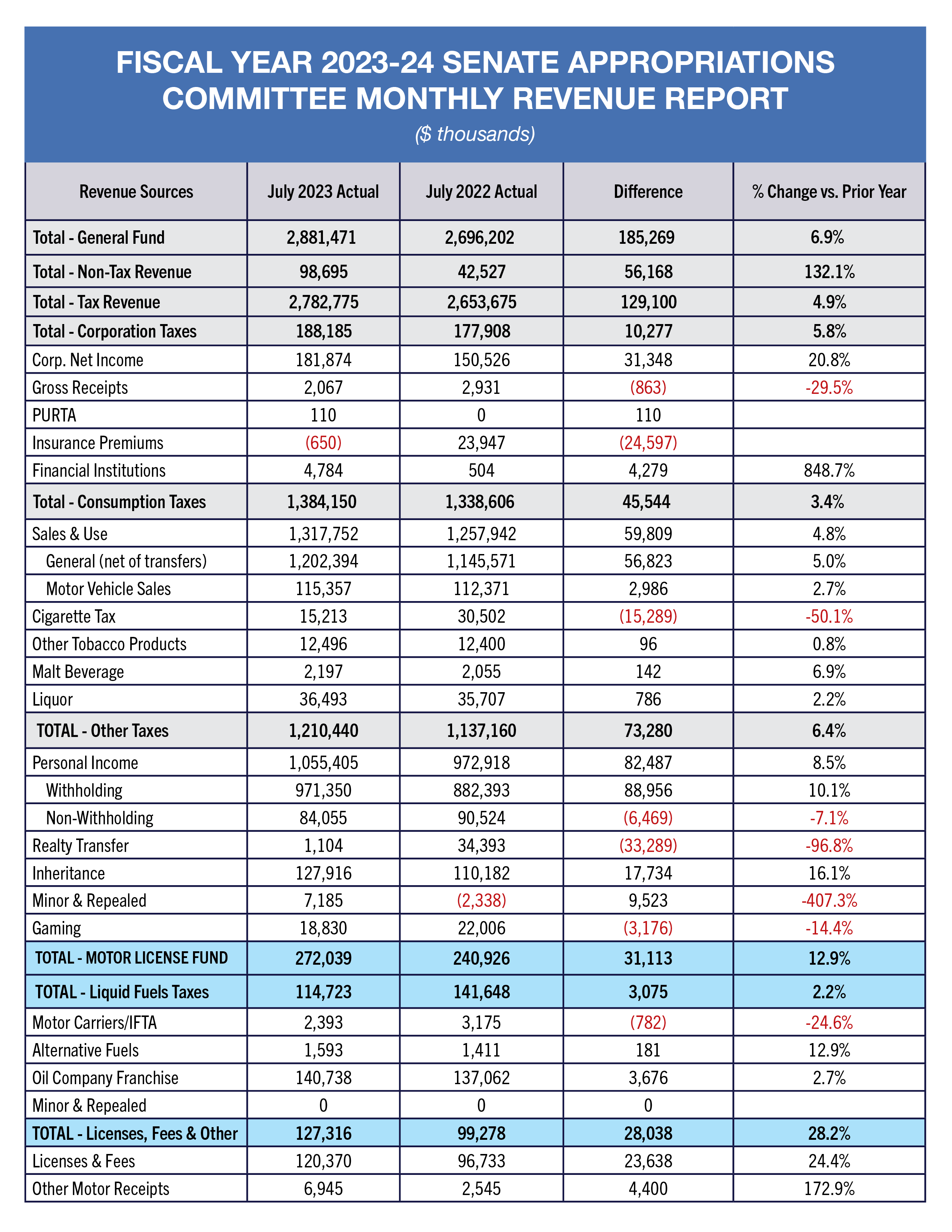

- Total General Fund revenues were $185.3 million, or 6.9%, higher than last year at this time.

- General Fund tax revenue was $129.1 million, or 4.9%, more than last year.

- Corporate net income tax collections were $31.3 million, or 20.8%, higher than July 2022 collections.

Fiscal Year 2023-24 Revenues Off to a Good Start

Total General Fund revenue for July 2023 was $2.88 billion. Revenue collections were $185.3 million higher than July 2022, which is a 6.9% increase over last year. Because the FY 2023-24 budget has just recently been finalized, the monthly distribution of the Official General Fund Revenue Estimate against which to compare current year revenue collections is not yet available from the Department of Revenue. Therefore, General Fund revenues can be compared only against last year’s collections.

Fiscal Year 2023-24 vs. Fiscal Year 2022-23:

- Total General Fund revenues were $185.3 million, or 6.9%, higher than last year at this time.

- General Fund tax revenue was $129.1 million, or 4.9%, more than last year.

- Corporate net income tax collections were $31.3 million, or 20.8%, higher than July 2022 collections.

- Sales and use tax (SUT) collections were $59.8 million, or 4.8%, more than FY 2022-23 collections in July.

- General (i.e., non-motor) SUT collections were $56.8 million, or 5%, higher than last year.

- SUT collections on motor vehicle sales exceeded last year’s collections by $3 million, or 2.7%.

- Cigarette tax collections of $15.2 million were $15.3 million, or 50.1%, less than July 2022.

- Cigarette tax collections were nearly $10 million lower than last year for the month.

- The transfer of cigarette tax collections to Philadelphia required by Act 84 of 2016 increased by $5.5 million, from $31 million to $36.5 million.

- Personal income tax (PIT) collections exceeded last year’s collections by $82.5 million, or 8.5%.

- PIT collections from withholding were $89 million, or 10.1%, higher than July 2022 collections.

- Non-withheld PIT collections (i.e., estimated and annual payments) were $6.5 million, or 7.1%, lower than last year.

- Realty transfer tax (RTT) collections of $1.1 million were $33.3, or 96.8%, lower than last year.

- Act 108 of 2022 increased the annual RTT transfer to the Housing Affordability and Rehabilitation Enhancement Fund (PHARE Fund) from $40 million in FY 2022-23 to $60 million in FY 2023-24.

- RTT collections would have been $13.3 million instead of $33.3 million lower than last year if the PHARE Fund transfer had not been increased by $20 million this fiscal year.

- Inheritance tax collections of $127.9 million exceeded last year’s collections by $17.7 million, or 16.1%.

- Gaming revenue deposited into the General Fund decreased by $3.2 million, or 14.4%, from $22 million in July 2022 to $18.8 million in July 2023.

- Non-tax revenues of $98.7 million were $56.2 million, or 132.1%, more than last year, led by strong Treasury investment returns.

Motor License Fund:

- Motor License Fund revenues of $272 million were $31.1 million, or 12.9%, higher than July 2022 collections.