The Highlights

- General Fund revenue collections exceeded expectations by $499.4 million in March.

- For the year, revenue collections are $1.15 billion above estimates.

- Sales and use tax (SUT) collections were $25 million below estimate and lower than last year’s collections. Closely monitoring these collections for continued weakness could help signify any potential slowing of the economy.

- Roughly half of the $7.2 million in Farmer’s Market Food Coupons for WIC recipients and low-income seniors were not redeemed last year.

April 2023

March General Fund Revenues Overperform

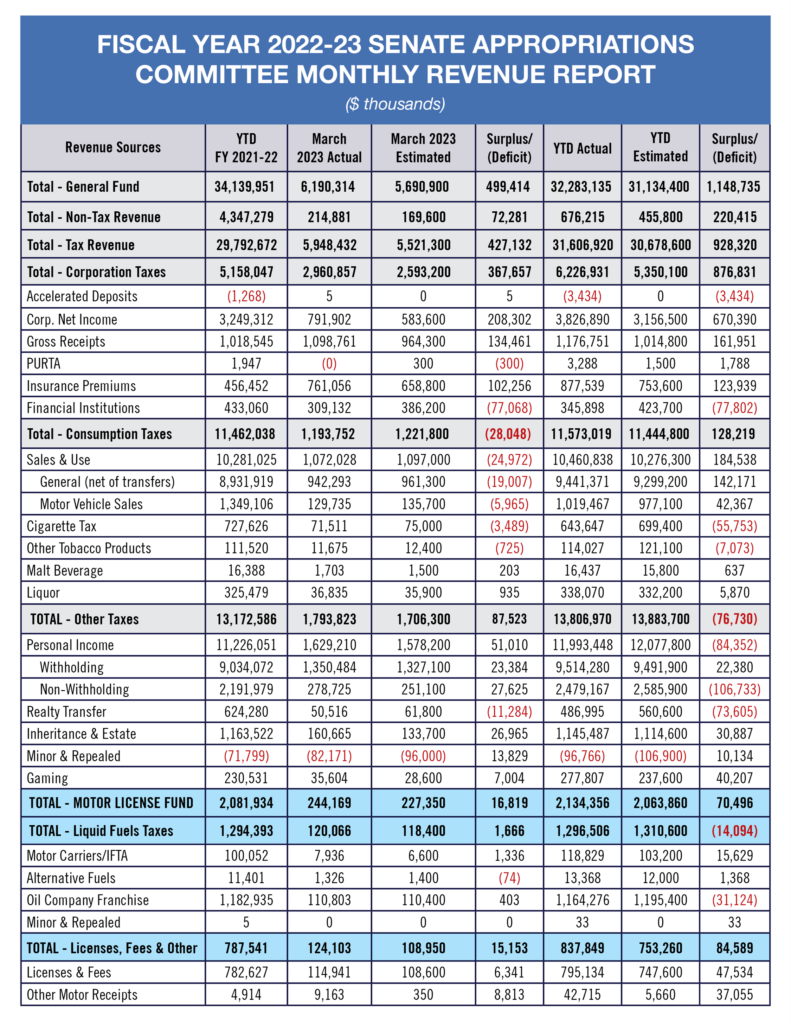

General Fund revenue collections for the month of March significantly outperformed expectations by $499.4 million, with most corporation taxes leading the way (e.g., corporate net income tax, gross receipts tax, insurance premiums tax). Non-tax revenues were also above estimate by $72.3 million, much of which was attributable to increased investment earnings and unclaimed property revenue remitted by the Treasury Department. General Fund revenues are now $1.15 billion above estimate even though the Governor’s budget calls for a revenue surplus of only $347.5 million by fiscal year’s end in June.

Payments received from estimated quarterly corporate net income tax payments exceeded the estimate by $140.3 million, or 36.1%. Another round of these payments is due in June, so March’s strong performance hopefully will result in solid June collections as well. The vast majority of gross receipts tax payments are received once per year in March, and GRT collections were $134.5 million, or 13.9%, above estimate, primarily resulting from strong sales, or high prices, of electric energy. Insurance premiums tax collections were $102.3 million above estimate, but financial institution taxes (e.g., bank shares tax and mutual thrift tax) were $77.1 million, or 20%, below estimate.

Sales and use tax (SUT) collections were $25 million, or 2.3%, below estimate for the month; but, and perhaps more important, sales and use tax collections in March were below last year’s collections. SUT is the second-largest source of revenue for the General Fund and is mostly due on a “pay-as-you-go” basis throughout the year, so closely monitoring these collections for continued weakness could help signify any potential slowing of the economy.

March General Fund Revenue:

- General Fund revenue collections of $6.19 billion were above the monthly estimate by $499.4 million, or 8.8%.

- General Fund tax revenues were ahead of estimate by $427.1 million, or 7.7%.

- Corporation taxes were $367.7 million, or 14.2%, above estimate.

- Gross receipts tax collections exceeded the estimate by $134.5 million, or 13.9%.

- Sales and use tax (SUT) collections missed the estimate by $25 million, or 2.3%, for the month.

- Personal income tax (PIT) collections were above estimate by $51 million, or 3.2%.

- Realty transfer tax collections were below estimate by $11.3 million, or 18.3%.

- Inheritance tax collections exceeded the estimate by $27 million, or 20.2%.

- Non-tax revenues beat the estimate by $72.3 million, or 42.6%.

Fiscal Year 2022-23 vs. the Official Revenue Estimate To-Date:

- Total General Fund revenues are $1.15 billion, or 3.7%, higher than the Official Revenue Estimate through the month of March.

- General Fund tax revenue is $928.3 million, or 3%, higher than estimated.

- Corporation taxes are $876.8 million, or 16.4%, above estimate.

- Sales and use taxes are $184.5 million, or 1.8%, above estimate.

- General SUT collections exceed the estimate by $142.2 million, or 1.5%.

- SUT collections on motor vehicle sales are $42.3 million, or 4.3%, over the estimate.

- Personal income tax collections are lower than the estimate by $84.4 million, or 0.7%.

- Withheld PIT is $22.3 million, or 0.2%, above estimate.

- Estimated PIT payments are $275.5 million, or 13.3%, below estimate.

- Annual PIT payments are $168.8 million, or 33%, above estimate.

- Realty transfer tax revenues are $73.6 million, or 13.1%, below estimate.

- Inheritance tax collections exceed estimate by $30.9 million, or 2.8%.

- Non-tax revenues are $220.4 million, or 48.4%, above estimate.

Fiscal Year 2022-23 vs. FY 2021-22:

- Total General Fund revenues through March 2023 are $1.86 billion, or 5.4%, lower than last year at this time because of a one-time transfer from the federal Coronavirus State Fiscal Recovery Fund in the amount of $3.84 billion that occurred in November 2021.

- General Fund tax revenue is $1.81 billion, or 6.1%, higher than last year.

- Corporation taxes are $1.07 billion, or 20.7%, higher.

- Sales and use tax collections are $179.8 million, or 1.7%, higher than last year through March. So far this fiscal year, $384.1 million from sales tax on motor vehicle sales has been transferred to the Public Transportation Trust Fund.

- Personal income tax collections exceed last year’s collections by $767.4 million, or 6.8%. $45 million was transferred from PIT in July 2022 to the Election Integrity Restricted Account.

- Non-tax revenues are $3.67 billion less than last fiscal year through March because of last year’s $3.84 billion transfer from the federal Coronavirus State Fiscal Recovery Fund to the General Fund for revenue replacement in accordance with federal law.

Motor License Fund:

- Motor License Fund revenues are above estimate by $70.5 million, or 3.4%, through March.

- Motor License Fund revenues are $52.4 million, or 2.5%, higher than last fiscal year at this time.

Farmers’ Market Food Coupon Program Highlighted

The Senate Appropriations Committee received testimony from the Department of Agriculture and Secretary Nominee Russell Redding on March 28, 2023, regarding the agency’s FY 2023-24 budget proposal. During the hearing, Chairman Martin asked Secretary Redding about the Department of Agriculture’s Farmers’ Market Food Coupon program. Specifically, Chairman Martin pointed out, as noted in the Independent Fiscal Office’s performance-based budget review of the department, that the redemption rate for available food coupons is low.

$7.2 million in state and federal funds were available for Farmer’s Market Food Coupons, but just $3.6 million in coupons were redeemed last year. Secretary Redding noted that the department could use all the help it could get to make sure the public is aware of the program and that the valuable food security program is better utilized by those who qualify for food coupons.

The WIC Farmers’ Market Nutrition Program (FMNP) and Senior Farmers’ Market Nutrition Program (SFMNP) provide WIC recipients and low-income seniors with fresh, nutritious, unprepared, locally grown fruits, vegetables and herbs from approved farmers in Pennsylvania. Only farmers authorized by the state agency may accept and redeem FMNP and SFMNP checks. Individuals who exclusively sell produce grown by someone else or purchased from a wholesale distributor cannot be authorized to participate in the FMNP.

How it works:

- Easily find a market or farm stand to spend Senior or WIC PA Farmers’ Market Nutrition Program checks.

- FMNP season runs from June 1-November 30 each year.

- Enter a location to find the nearest participating vendor.

- Quick access to address, phone number, hours and directions.

Recipient Eligibility

FMNP – Recipients must be on the WIC program to receive this benefit and receive the benefit during the quarterly WIC visit (May – September).

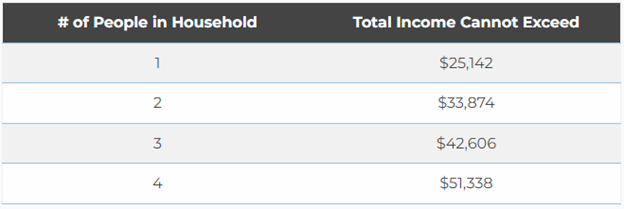

SFMNP – Seniors must be 60 years of age or older and meet the federal income guidelines. The checks are available on a first-come, first-served basis. The 2022 household income guidelines are as follows:

How to Apply

Call your County Aging office to find out when and where they are distributing the checks/vouchers, which are available on first-come, first-served basis. Please visit Farmers Market Nutrition Programs (pa.gov) for more information.

How the Program Works for Recipients

Recipients are given a list of participating farmers and farmers’ markets when they receive their checks. These checks are redeemed for fresh fruits and vegetables grown in Pennsylvania. Each eligible recipient receives four $6.00 SFMNP checks to redeem at qualified farmers’ markets or roadside stands. There are over 1,160 FMNP participating farmers at 828 farm stands and 88 farmers’ markets in Pennsylvania.

Where to use Checks

Visit www.pafmnp.pa.gov to find a market close by that accepts the FMNP checks. When you are at the market, look for the white FMNP signs to know which vendors will accept the checks.

What to Buy

The checks can be redeemed for Pennsylvania fresh fruits and vegetables only. Processed food such as jams, honey, nuts, cider or baked goods do not qualify. Also, citrus and other tropical fruits are not allowed.