The Highlights

- General Fund tax revenues were $90.7 million lower than the monthly estimate in May, the third time in the past five months that tax revenues have failed to meet projections.

- For the 2022-23 Fiscal Year, Personal Income Tax collections are nearly $400 million below projections.

- The non-partisan Independent Fiscal Office is projecting General Fund revenues of $45.29 billion next year, which is modest growth of 1.3% over the current year.

June 2023

May Revenue Update

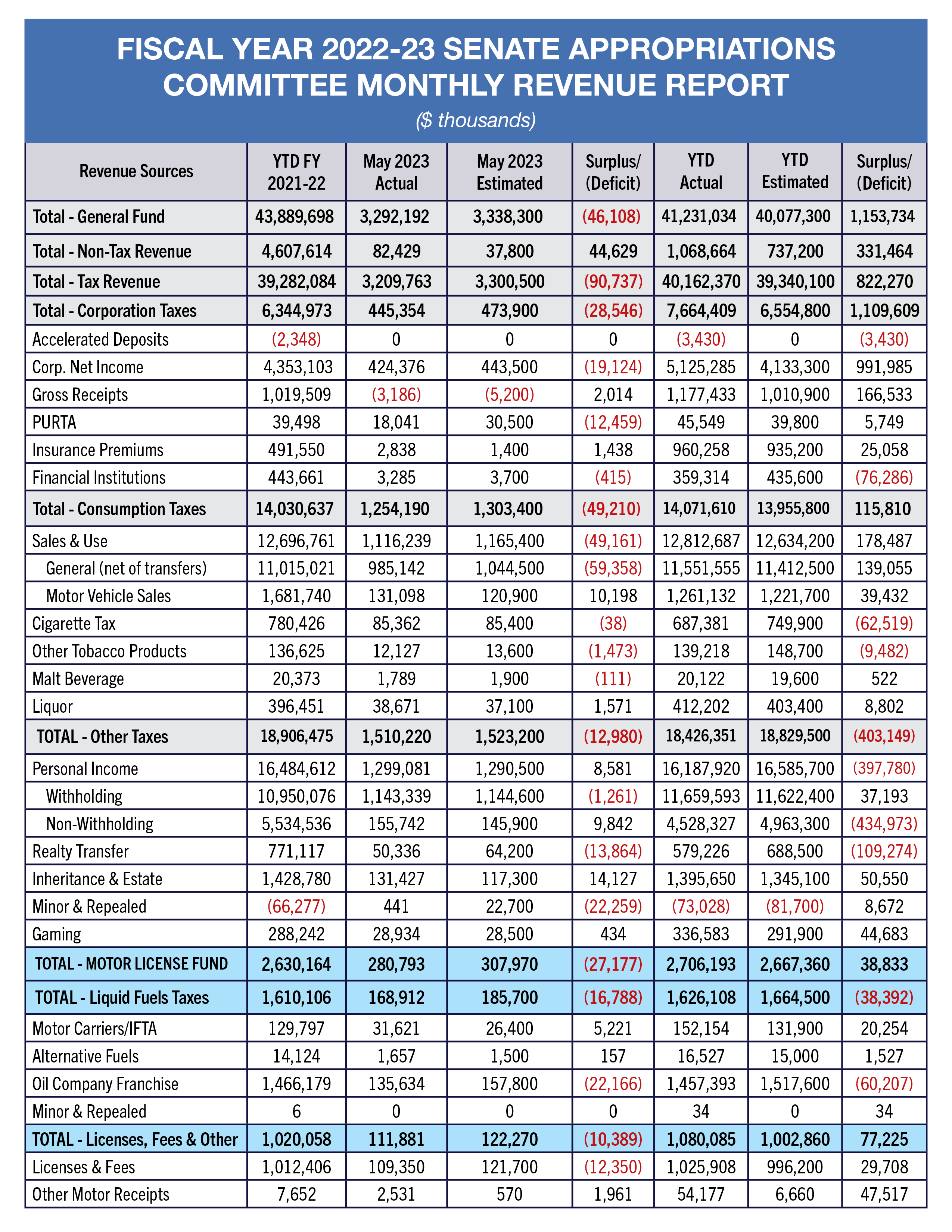

General Fund revenue collections in May were $46.1 million below estimate for the month. General Fund tax revenues were $90.7 million lower than the monthly estimate, but non-tax revenues were $44.6 million higher than the estimate. General Fund revenues are $1.15 billion above estimate for the year-to-date with one month remaining in the fiscal year. Non-tax revenues continue to benefit from Treasury investment income earned on cash in the General Fund at relatively higher interest rates than we have experienced in recent years. Nearly 32% of the year-to-date General Fund revenue surplus is attributable to interest earned on the General Fund cash balance.

The Independent Fiscal Office (IFO) released its Initial Revenue Estimate for FY 2023-24 on May 24th. The IFO’s recent report projects that the General Fund revenue surplus for the current fiscal year (FY 2022-23) will be $1.13 billion higher than the Administration’s Official General Fund Revenue Estimate. However, it is worth noting that General Fund tax revenue has been below estimate in three out of the five months since January 2023, including April and May.

For FY 2023-24, the IFO is projecting General Fund revenues of $45.29 billion, which is $712 million more than the IFO estimated in its mid-year update from January 2023 and $910.5 million higher than the base revenues assumed in the Governor’s Executive Budget (excluding any proposed tax or revenue modifications). Projected General Fund revenue growth in FY 2023-24 over the current fiscal year is a modest 1.3%. The IFO will issue its final revenue estimate for FY 2023-24 on June 20th.

May 2023 General Fund Revenue vs. Monthly Estimate:

- General Fund revenue collections of $3.29 billion were below the monthly estimate by $46.1 million, or 1.4%.

- General Fund tax revenues were short of estimate by $90.7 million, or 2.7%.

- Corporation taxes were $28.5 million, or 6%, below estimate.

- Sales and use tax collections missed the estimate by $49.2 million, or 4.2%, for the month.

- Personal income tax collections exceeded estimate by $8.6 million, or 0.7%.

- Realty transfer tax revenues were $13.9 million, or 21.6%, below estimate.

- Inheritance tax collections were $14.1 million, or 12%, above estimate.

- Non-tax revenues beat the estimate by $44.6 million, or 118.1%.

Fiscal Year 2022-23 vs. the Official Revenue Estimate To-Date:

- Total General Fund revenues are $1.15 billion, or 2.9%, higher than the Official Revenue Estimate through the month of May.

- General Fund tax revenue is $822.3 million, or 2.1%, above estimate.

- Corporation taxes are $1.1 billion, or 16.9%, above estimate.

- Sales and use taxes are $178.5 million, or 1.4%, higher than the estimate.

- General SUT collections are $139.1 million, or 1.2%, above estimate.

- SUT collections on motor vehicle sales are $39.4 million, or 3.2%, higher than the estimate.

- Personal income tax collections are below estimate by $397.8 million, or 2.4%.

- Withheld PIT is $37.2 million, or 0.3%, above estimate.

- Non-withheld PIT (annual & estimated payments) is $435 million, or 8.8%, below estimate.

- Realty transfer tax collections are $109.3 million, or 15.9%, lower than the estimate.

- Inheritance tax collections exceed estimate by $50.6 million, or 3.8%.

- Non-tax revenues are $331.5 million, or 45%, higher than the estimate.

Fiscal Year 2022-23 vs. Fiscal Year 2021-22:

- Total General Fund revenues through May 2023 are $2.66 billion, or 6.1%, lower than last year at this time because of a one-time transfer from the federal Coronavirus State Fiscal Recovery Fund in the amount of $3.84 billion that occurred in November 2021.

- General Fund tax revenue is $880.3 million, or a modest 2.2%, higher than last year.

- Corporation taxes are $1.32 billion, or 20.8%, higher.

- Sales and use tax collections are $115.9 million, or 0.9%, higher than last year through May. So far this fiscal year, $467.7 million from sales tax on motor vehicle sales has been transferred to the Public Transportation Trust Fund.

- Personal income tax collections are below last year’s collections by $296.7 million, or 1.8%. Last year saw historic annual and estimated PIT payments that did not repeat this April and May.

- Non-tax revenues are $3.54 billion less than last fiscal year through May because of last year’s $3.84 billion transfer from the federal Coronavirus State Fiscal Recovery Fund to the General Fund for revenue replacement in accordance with federal law.

Motor License Fund:

- Motor License Fund revenues are above estimate by $38.8 million, or 1.5%, through May. $48.3 million of the surplus is attributable to increased Treasury earnings on MLF investments, which means that MLF tax and fee revenue is $9.5 million below estimate.

- Motor License Fund revenues are $76 million, or 2.9%, higher than last fiscal year at this time.