The Highlights

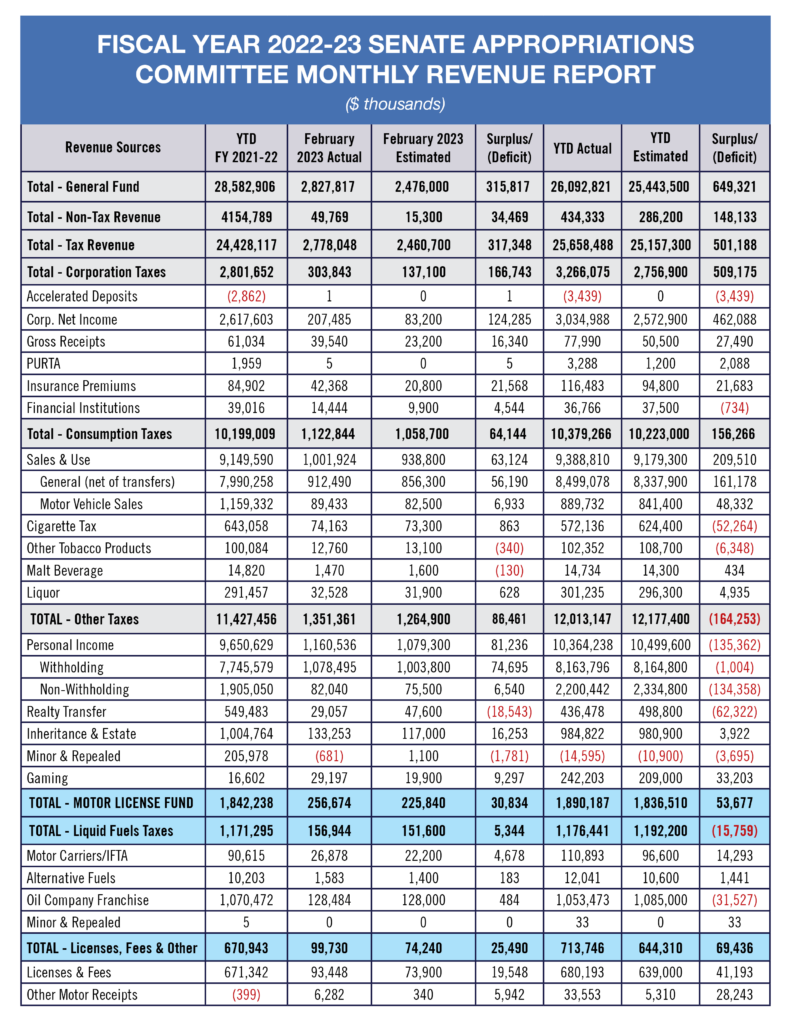

- General Fund revenue collections for the fiscal year-to-date are $649.3 million ahead of estimate.

- Through February 2023, General Fund revenues are $2.49 billion, or 8.7%, lower than last year at this time.

- Realty transfer tax collections were $18.5 million, or 39%, below estimate.

March 2023

General Fund Revenues Bounce Back in February

General Fund revenue collections in February were $351.8 million above estimate for the month. However, approximately $93.5 million of General Fund deposits delayed from January were posted to February because of the Department of Revenue’s ongoing transition to new accounting software. General Fund revenue collections for the fiscal year-to-date are $649.3 million ahead of estimate. The Governor’s FY 2023-24 Executive Budget will include updated revenue projections for the current 2022-23 fiscal year.

February 2023 General Fund Revenue vs. Monthly Estimate:

- General Fund revenue collections of $2.83 billion were above the monthly estimate by $351.8 million, or 14.2%, bolstered by more than $93 million carried over from January.

- General Fund tax revenues were above estimate by $317.3 million, or 12.9%.

- Corporation taxes were $166.7 million, or 121.6%, above estimate.

- Sales and use tax collections beat the estimate by $63.1 million, or 6.7%, for the month.

- Personal income tax collections were above estimate by $81.2 million, or 7.5%.

- Realty transfer tax collections were $18.5 million, or 39%, below estimate.

- Inheritance tax collections exceeded the monthly estimate by $16.3 million, or 13.9%.

- Non-tax revenues exceeded the estimate by $34.5 million, or 225.3%.

Fiscal Year 2022-23 vs. the Official Revenue Estimate To-Date:

- Total General Fund revenues are $649.3 million, or 2.6%, higher than the Official Revenue Estimate through the month of February.

- General Fund tax revenues are $501.2 million, or 2%, above estimate.

- Corporation taxes are $509.2 million, or 18.5%, above estimate.

- Sales and use taxes (SUT) are $209.5 million, or 2.3%, higher than the estimate.

- General SUT collections are $161.2 million, or 1.9%, above estimate.

- SUT collections on motor vehicle sales are $48.3 million, or 5.7%, higher than the estimate.

- Cigarette tax revenues are $52.3 million, or 8.4%, below estimate.

- Personal income tax collections are short of the estimate by $135.4 million, or 1.3%.

- Withheld PIT is $1 million below estimate.

- Non-withheld PIT (estimated & annual payments) is $134.4 million, or 5.8%, short of estimate.

- Realty transfer tax collections are $62.3 million, or 12.5%, below estimate through February.

- Inheritance tax collections are $3.9 million, or 0.4%, above estimate.

- General Fund gaming tax revenues are $33.2 million, or 15.9%, ahead of estimate.

- Non-tax revenues are $148.1 million, or 51.8%, higher than the estimate.

Fiscal Year 2022-23 vs. Fiscal Year 2021-22:

- Total General Fund revenues through February 2023 are $2.49 billion, or 8.7%, lower than last year at this time because of a one-time transfer from the federal Coronavirus State Fiscal Recovery Fund in the amount of $3.84 billion that occurred in November 2021.

- General Fund tax revenue is $1.23 billion, or 5%, higher than last year.

- Corporation taxes are $464.4 million, or 16.6%, higher.

- Sales and use tax collections are $239.2 million, or 2.6%, higher than last year through February. So far, this fiscal year, $346.7 million from sales tax on motor vehicle sales has been transferred to the Public Transportation Trust Fund.

- Personal income tax collections exceed last year’s collections by $713.6 million, or 7.4%. $45 million was transferred from PIT in July 2022 to the Election Integrity Restricted Account.

- Non-tax revenues are $3.72 billion less than last fiscal year through February because of last year’s $3.84 billion transfer from the federal Coronavirus State Fiscal Recovery Fund to the General Fund for revenue replacement in accordance with federal law.

Motor License Fund:

- Motor License Fund revenues are $53.7 million, or 2.9%, above estimate through February.

- Motor License Fund revenues are $47.9 million, or 2.6%, higher than last fiscal year at this time.