The Highlights

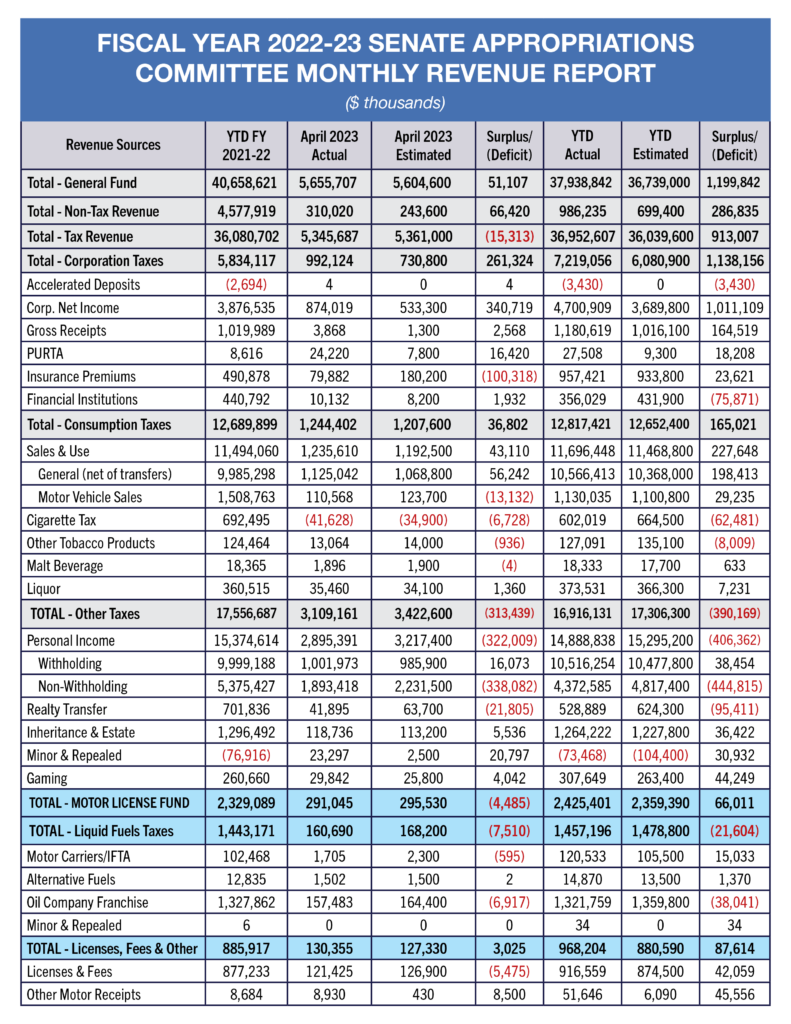

- Tax revenues in April were $15.3 million below estimate, indicating a potential moderation of state revenues.

- Personal income tax collections were $322 million below estimate – 10% lower than projected.

- For the 2022-23 Fiscal Year, revenue collections remain $1.2 billion higher than estimates, driven largely by corporation taxes that are nearly 19% above projections.

MAY 2023

April Revenues Show Signs of Moderation

General Fund revenue collections for April exceeded the monthly estimate by $51.1 million, bringing the year-to-date revenue surplus to $1.2 billion. For the month, tax revenue missed estimate by $15.3 million, which was offset by $66.4 million of excess non-tax revenues. General Fund revenues were bolstered by continued strong collections in corporate net income tax, but personal income tax collections missed estimate by $322 million, driven by a $186 million shortfall in quarterly estimated payments and a $152 million deficit in annual payments made for 2022 tax returns.

April General Fund Revenue:

- General Fund revenue collections of $5.66 billion were above the monthly estimate by $51.1 million, or 0.9%.

- General Fund tax revenues were short of estimate by $15.3 million, 0.3%.

- Corporation taxes were $261.3 million, or 35.8%, above estimate.

- Sales and use tax (SUT) collections exceeded estimate by $43.1 million, or 3.6%, for the month.

- General SUT collections were $56.2 million, or 5.3%, above estimate.

- SUT collections on motor vehicle sales were $13.1 million, or 10.6%, below estimate.

- Personal income tax (PIT) collections were below estimate by $322 million, or 10%.

- Withheld PIT was $16.1 million, or 1.6%, above estimate.

- Non-withheld PIT from quarterly estimated payments was $186.4 million, or 29.1%, below estimate.

- Non-withheld PIT from annual payments missed estimate by $151.7 million, or 9.5%.

- Non-tax revenues were above estimate by $66.4 million, or 27.3%.

- Treasury investment income was $48.4 million more than estimated.

- Treasury escheats (i.e., unclaimed property) revenue exceeded estimate by $29.9 million.

- Other non-tax licenses and fees revenue, miscellaneous revenue and fines missed estimate by $11.9 million.

Fiscal Year 2022-23 vs. the Official Revenue Estimate To-Date:

- Total General Fund revenues are $1.2 billion, or 3.3%, higher than the Official Revenue Estimate through the month of April.

- General Fund tax revenue is $913 million, or 2.5%, higher than estimated.

- Corporation taxes are $1.14 billion, or 18.7%, above estimate.

- Sales and use taxes are $227.6 million, or 2%, above estimate.

- General SUT collections are $198.4 million, or 1.9%, above estimate.

- SUT collections on motor vehicle sales are $29.2 million, or 2.7%, over estimate.

- Personal income tax collections are below estimate by $406.4 million, or 2.7%.

- Withheld PIT is $38.5 million, or 0.4%, above estimate.

- Non-withheld PIT (annual & estimated payments) is $444.8 million, or 9.2%, below estimate.

- Cigarette tax revenues are $62.5 million, or 9.4%, below estimate.

- Realty transfer tax revenues are $95.4 million, or 15.3%, short of estimate.

- Inheritance tax revenues are $36.4 million, or 3%, higher than the estimate.

- General Fund gaming revenues exceed estimate by $44.2 million, or 16.8%.

- Non-tax revenues are $286.8 million, or 41%, over estimate.

Fiscal Year 2022-23 vs. FY 2021-22:

- Total General Fund revenues through April 2023 are $2.72 billion, or 6.7%, lower than last year at this time because of a one-time transfer from the federal Coronavirus State Fiscal Recovery Fund in the amount of $3.84 billion that occurred in November 2021.

- General Fund tax revenue is $871.9 million, or 2.4%, higher than last year.

- Corporation taxes are $1.38 billion, or 23.7%, higher.

- Sales and use tax collections are $202.4 million, or 1.8%, higher than last year through April. So far this fiscal year, $423.2 million from sales tax on motor vehicle sales has been transferred to the Public Transportation Trust Fund.

- Personal income tax collections are below last year’s collections by $485.8 million, or 3.2%. Last year saw historic annual and estimated PIT payments that did not repeat this April.

- Non-tax revenues are $3.59 billion less than last fiscal year through April because of last year’s $3.84 billion transfer from the federal Coronavirus State Fiscal Recovery Fund to the General Fund for revenue replacement in accordance with federal law.

Motor License Fund:

- Motor License Fund revenues are above estimate by $66 million, or 2.8%, through April.

- Motor License Fund revenues are $96.3 million, or 4.1%, higher than last fiscal year at this time. $43 million of the surplus is attributable to increased Treasury earnings on MLF investments.