November 2023

Highlights

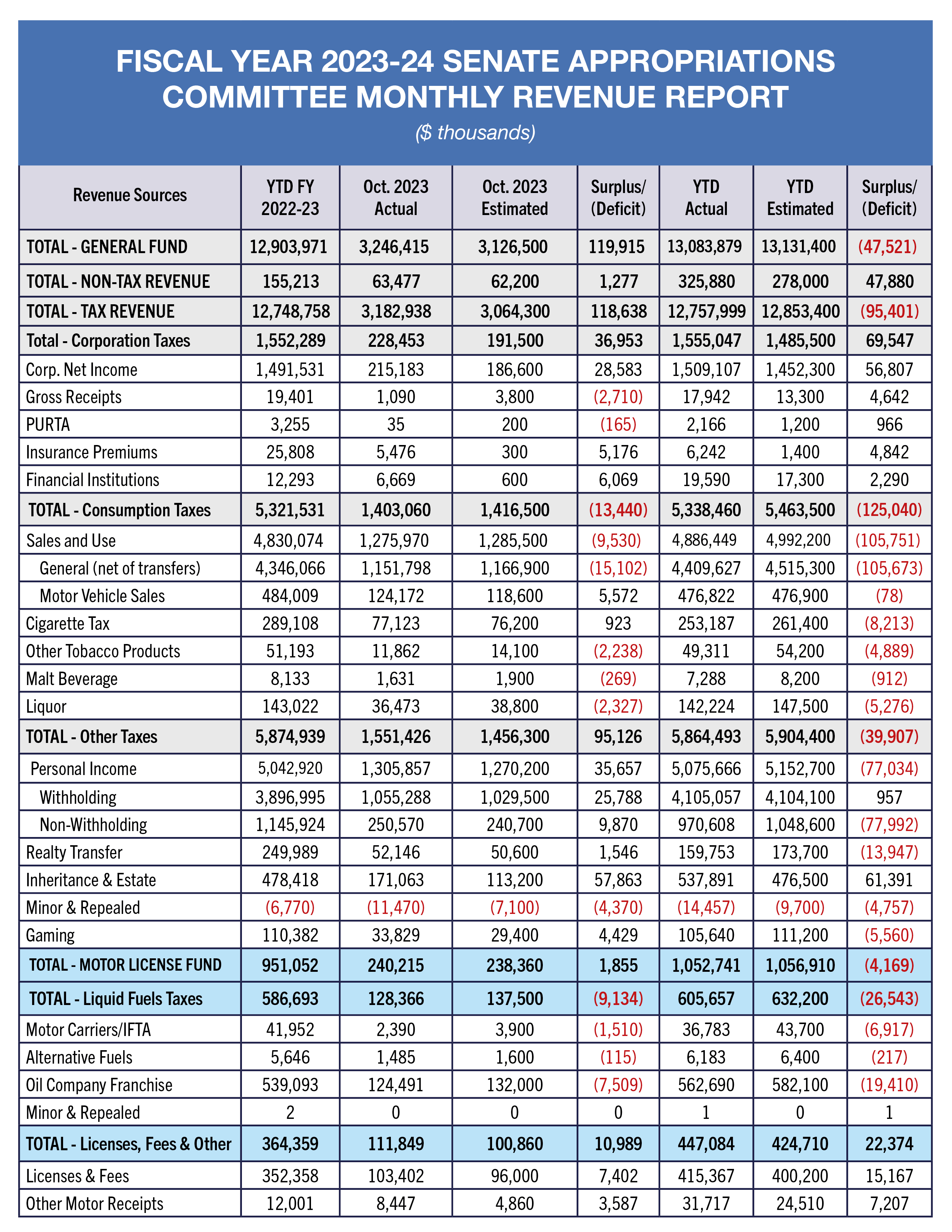

- Total General Fund tax revenues were $118.6 million, or 3.9%, above the monthly estimate.

- Total General Fund revenue collections for the first four months of the fiscal year are short of estimate by $47.5 million, or 0.4%.

- Personal income tax exceeded estimate for the month of October by $35.6 million, or 2.8%, but remains below estimate on the fiscal year by $77 million, or 1.5%.

- Consumer spending remains stagnant, as sales and use tax collections failed to meet estimate for the fourth consecutive month in the fiscal year.

General Fund Revenues Exceed Expectations

Total General Fund revenue collections for the month of October exceeded estimate by $119.8 million, or 3.8%. Total General Fund tax revenues were $118.6 million, or 3.9%, above the monthly estimate, and non-tax revenue was $1.2 million, or 1.9%, above the monthly estimate. Total General Fund revenue collections for the first four months of the fiscal year are short of estimate by $47.5 million, or 0.4%.

Consumer spending remains stagnant, as sales and use tax (SUT) collections failed to meet estimate for the fourth consecutive month in the fiscal year. Total sales and use tax revenue fell short of estimate by $9.5 million, or 0.7%, for the month of October and is below estimate by $105.8 million, or 2.1%, for the fiscal year. Personal income tax (PIT) exceeded estimate for the month of October by $35.6 million, or 2.8%, but remains below estimate on the fiscal year by $77 million, or 1.5%. Of the monthly overage, $15.6 million is attributable to “annual payments”, most of which are likely to have been related to the filing of extended returns from the 2022 tax year. Real-time payments had mixed results, as withholding payments exceeded estimate by $25.8 million, or 2.5%, while quarterly payments were short of estimate by $5.8 million, or 6.4%.

Corporate net income tax (CNIT) exceeded the monthly estimate by $28.6 million, or 15.3%. Annual CNIT collections related to the 2022 filing year were above estimate by $29.7 million, or 26.4%, but estimated CNIT payments for the 2023 tax year fell short of estimate by $1.1 million, or 1.5%.

October 2023 General Fund Revenue vs. Monthly Estimate

- General Fund revenue collections of $3.25 billion were above monthly estimate by $119.8 million, or 3.8%.

- General Fund tax revenues were above estimate by $118.6 million, or 3.9%.

- Total corporation taxes were $37 million above estimate, or 19.3%.

- Sales and use tax collections were below estimate by $9.5 million, or 0.7%.

- Personal income tax collections exceeded estimate by $35.6 million, or 2.8%.

- Inheritance tax collections were $57.9 million, or 51.1%, higher than the monthly estimate, which accounted for nearly half of the $118.6 million monthly tax revenue surplus above the estimate.

- Non-tax revenues exceeded estimate by $1.2 million, or 1.9%.

Fiscal Year 2023-24 vs. Official Revenue Estimate To-Date

- Total General Fund revenues are $47.5 million, or 0.4%, below the Official Revenue Estimate through the month of October.

- General Fund tax revenue is $95.4 million, or 0.7%, below estimate.

- Corporation taxes are $69.6 million, or 4.7%, above estimate.

- Sales and use taxes are $105.8 million below estimate, or 2.1%.

- General SUT collections are $105.7 million below estimate, or 2.3%.

- SUT collections on motor vehicle sales are just below estimate by only $78,000.

- Personal income tax collections are below estimate by $77 million, or 1.5%.

- Withheld PIT is just over estimate by $957,000.

- Non-withheld PIT (annual & estimated payments) is $78 million, or 7.4%, below estimate. Annual payments are $46.2 million above estimate, but estimated payments are $124.2 million below estimate.

- Realty transfer tax is $13.9 million, or 8%, below estimate.

- Inheritance tax collections are $61.4 million, or 12.9%, above estimate.

- General Fund gaming taxes are $5.6 million, or 5%, below estimate.

- Non-tax revenues are $47.9 million, or 17.2%, above estimate.

Fiscal Year 2023-24 vs. Fiscal Year 2022-23

- Total General Fund revenues through October are $179.9 million, or 1.4%, higher than last year at this time.

- General Fund tax revenue is $9.2 million, or 0.1%, higher than last year.

- Corporation taxes are $2.8 million, or 0.2%, higher than last year.

- Sales and use tax collections are $56.4 million, or 1.2%, higher than last year through October.

- Personal income tax collections exceeded last year’s collections by $32.7 million, or 0.6%.

- Non-tax revenues are $170.6 million, or 110%, more than last fiscal year through October, led by substantial revenues from Treasury investment income due to higher than normal cash balances and a rising interest rate environment.

Motor License Fund

- Motor License Fund revenues are below estimate by $4.2 million, or 0.4%.

- Motor License Fund revenues are $101.7 million, or 10.7%, higher than last year at this time.