September 2023

Highlights

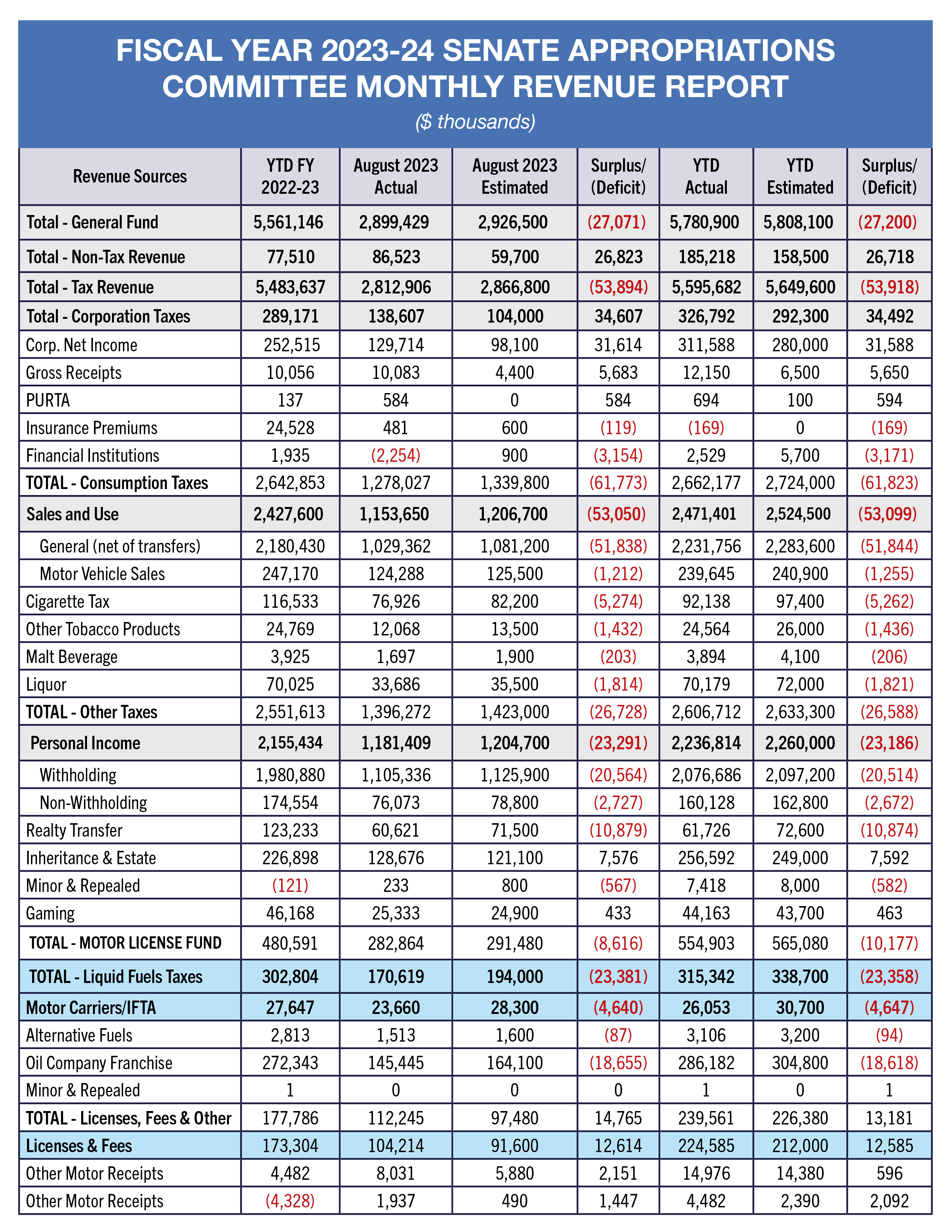

- General Fund revenue collections of $2.9 billion in August were below the monthly estimate by $27.1 million, or 0.9%.

- For the 2023-24 Fiscal Year to date, total General Fund revenues are $27.2 million, or 0.5%, lower than the Official Revenue Estimate through the month of August.

- New collective bargaining agreements with the state’s major labor unions are projected to cost taxpayers $3.2 billion over the next four years.

General Fund Revenues Slightly Below Expectations

General Fund revenues for August 2023 were $27.1 million, or 0.9%, below estimate for the month. General Fund tax revenues were $53.9 million, or 1.9%, lower than the monthly estimate, but non-tax revenue, which includes Treasury investment income, was $26.8 million above the estimate. General Fund tax revenue was $17.1 million, or 0.6%, less than last year for the month of August.

Total corporation tax revenues were $34.6 million, or 33.3%, above estimate, although August typically is not a large corporation tax collection month.

Sales and use tax (SUT) collections were below estimate by $53.1 million, or 4.4%, for the month and were 1.4% lower than August 2022 collections. Personal income tax (PIT) collections missed the estimate by $23.3 million, or 1.9%. PIT collections were $1.1 million, or 0.1%, lower than last year for the month of August. Collectively, sales and use tax and personal income tax make up nearly 72% of all General Fund revenues for the fiscal year.

August 2023 General Fund Revenue vs. Monthly Estimate:

- General Fund revenue collections of $2.9 billion were below the monthly estimate by $27.1 million, or 0.9%.

- General Fund tax revenues were below estimate by $53.9 million, or 1.9%.

- Corporation taxes were $34.6 million, or 33.3%, above estimate.

- Sales and use tax collections missed the estimate by $53.1 million, or 4.4%, for the month.

- General SUT collections were $51.9 million, or 4.8%, below estimate.

- SUT collections on motor vehicle sales were below estimate by $1.2 million, or 1%.

- Personal income tax collections were below estimate by $23.3 million, or 1.9%.

- Non-tax revenues were above estimate by $26.8 million, or 44.9%.

Fiscal Year 2023-24 vs. the Official Revenue Estimate To-Date:

- Total General Fund revenues are $27.2 million, or 0.5%, lower than the Official Revenue Estimate through the month of August.

- General Fund tax revenue is $53.9 million, or 1%, below estimate.

- Corporation taxes are $34.5 million, or 11.8%, above estimate.

- Sales and use taxes are $53.1 million, or 2.1%, short of estimate.

- General SUT collections are $51.8 million, or 2.3%, below estimate.

- SUT collections on motor vehicle sales are $1.3 million, or 2.3%, lower than the estimate.

- Personal income tax collections are below estimate by $23.2 million, or 1%.

- Withheld PIT is $20.5 million, or 1%, less than the estimate.

- Non-withheld PIT (annual & estimated payments) is $2.7 million, or 1.6%, below estimate.

- Realty transfer tax revenues are $10.9 million, or 15%, below estimate.

- Inheritance tax collections are $7.6 million, or 3%, above estimate.

- Non-tax revenues are $26.7 million, or 16.9%, above estimate.

Fiscal Year 2023-24 vs. Fiscal Year 2022-23:

- Total General Fund revenues through August are $219.8 million, or 4%, higher than last year at this time.

- Corporation taxes are $37.6 million, or 13%, more than last fiscal year.

- Sales and use tax collections are $43.8 million, or 1.8%, more than last year through August.

- Personal income tax collections exceed last year’s collections by $81.4 million, or 3.8%.

- Non-tax revenues are $107.7 million, or 139%, more than last fiscal year through August led by a substantial year-over-year increase in Treasury investment income.

Motor License Fund:

- Motor License Fund revenues are below the estimate by $10.2 million, or 1.8%, through August.

- Motor License Fund revenues are $74.3 million, or 15.5%, higher than last fiscal year at this time.

New Collective Bargaining Agreements Estimated to Cost $3.2 Billion

The Shapiro Administration recently ratified new collective bargaining agreements with the state’s major labor unions, including AFSCME, SEIU and Management/Non-Represented Employees.

The agreement would increase total salary costs by 20.25 percent over four years, which outpaces projected wage growth in Pennsylvania, which is estimated to be 16.9 percent over this time period.

The Senate Republican Appropriations Committee reviewed the economic impact of the new labor agreements for AFSCME, SEIU and Management/Non-Represented Employees, and they estimate the plan will increase salary and benefits of state employees by approximately $3.2 billion over the next four years.

Although salaries and benefits are set to increase, state employee staffing levels have continued to decline. Since 2003, filled salaried staffing positions have dipped from nearly 81,000 to less than 74,000, a decrease of more than 9 percent. The entities covered under the new collective bargaining agreement have seen a decline of 1,000 filled positions since 2019 alone.